Artificial Intelligence (AI) is no longer a futuristic concept – it’s already reshaping how we live, work, and invest. So, it’s fitting that this year’s IRFA Conference places AI at the heart of the conversation around retirement, savings, and investment. The rapid acceleration of technological innovation and data capabilities is creating meaningful opportunities for the financial services industry – and, more importantly, for long term investors.

As AI transforms the investment landscape, investors are eager to understand how it is impacting the decision making process and reshaping the role of human investment professionals. In our experience, AI enhances how the fusion of human expertise and machine intelligence can deliver superior performance for clients, even amid the uncertainties of the global equity markets.

Beyond the AI buzz

From self-driving cars to large language models like ChatGPT, AI has captured the public imagination – and headlines. But behind the hype lies a deeper evolution. In our view, AI isn’t a revolution that replaces what came before. It’s an evolution: a set of powerful tools that, when thoughtfully applied, can unlock differentiated insights and outcomes.

However, it’s not a universal solution. Not every investment challenge is suited to AI and applying it without caution can lead to poor results. Success lies in understanding where AI adds value – and where human judgment still reigns.

The ongoing evolution of AI in investment management

History shows that when new technologies emerge, the initial instinct is to apply them to existing problems. The real breakthroughs happen when we start solving problems that couldn’t be addressed before.

Take the internet, for example. In its early stages, access to the internet simply replicated what you could do via fax. Then, email emerged, and later, Google indexed the internet’s entire universe, becoming the gateway to information and knowledge, and creating entirely new opportunities.

Similarly, AI is still evolving, and its full potential will unfold over time. The AI landscape is vast, opening new avenues for processing data and extracting valuable insights. It can enable you to access useful information from text, images and sound, enhancing investment decision making. As AI techniques develop, we are continually exploring new methods to refine our models.

AI models in practice

Using historically representative data from the investment landscape, AI models can be trained to learn underlying patterns and provide a rich view of the market. They can not only help you to predict investment outcomes but also deepen your understanding of how market factors interact.

At M&G Investments, in our Global Equity Fund, we primarily use supervised machine learning, selecting data we believe is relevant for predicting share price movements. This is crucial in complex, noisy environments where it’s easy to capture spurious relationships in data that might not be relevant in the future. In a pre-filtering process, we identify data sources such as economic, fundamental, pricing and technical data. We also increasingly use natural language processing (NLP) techniques to extract sentiment data from sources such as company filings. The model learns how this data relates to future share price performance.

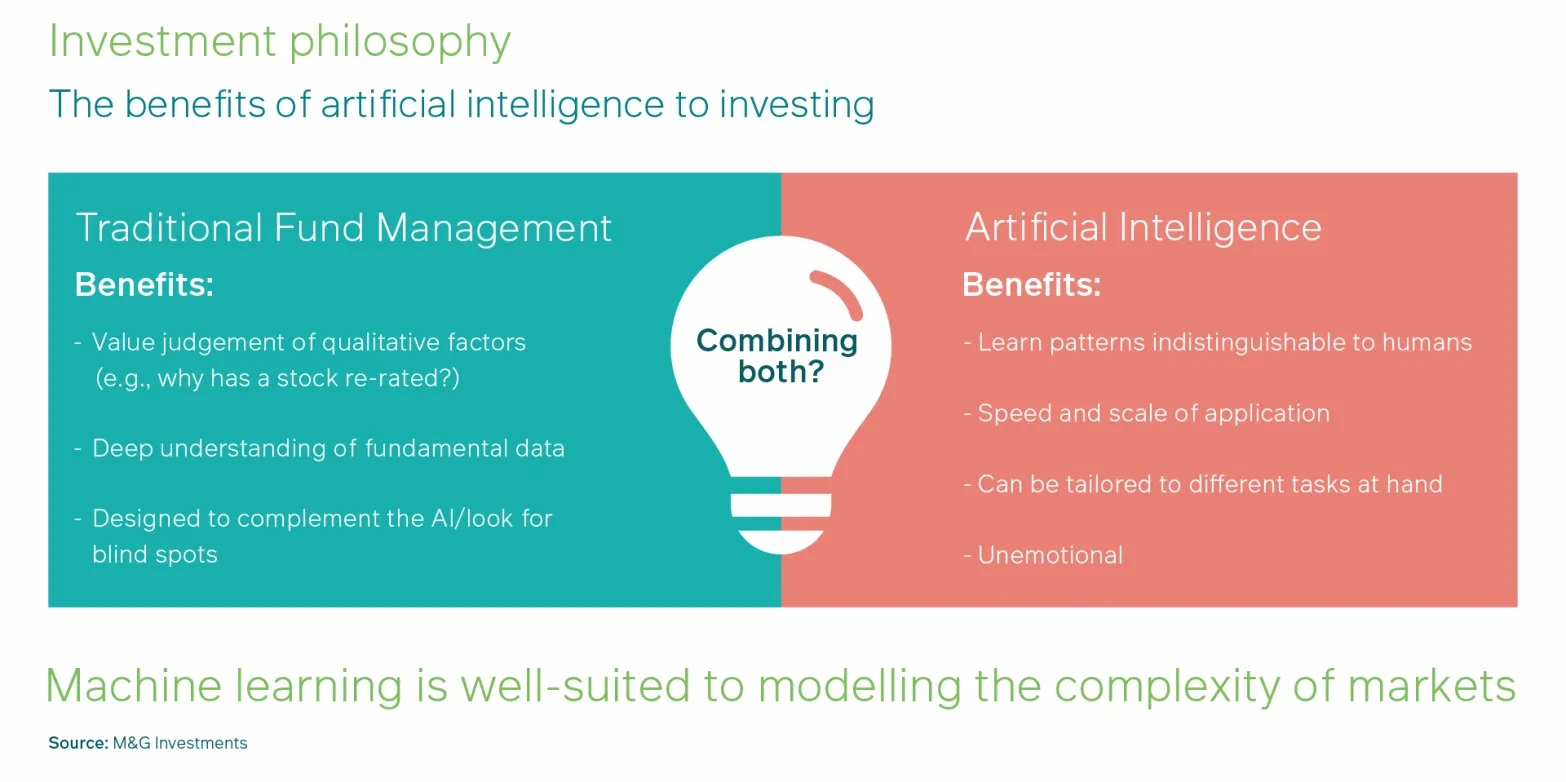

In our view, the real benefits of incorporating AI in the investment process come from blending the strengths of both humans and machines. This is the approach where we have seen real client benefit.

AI models can excel at identifying patterns and nuances in the data that are indistinguishable to human beings. They can also operate at a speed and scale that would be impossible for humans alone. AI models are also emotionless, which helps mitigate biases such as overconfidence or fear that can distort human decision making.

Yet AI isn’t infallible. Human judgment is crucial for addressing areas where AI models can’t always perform optimally. For example, humans can provide additional context to data, accounting for shifts in the market, and filling in the gaps where the AI might be blind to certain qualitative factors.

We believe that every stock selected should undergo a human check before being added. This to make sure that the things that have been accounted for are correct and consider any critical factors that may not be captured within the model. There are various techniques to manage large-scale data, to enable models to process nuances and outliers effectively. Not all outliers are errors, and models can be designed to distinguish between valid data and anomalies.

Risk management is another area where AI and human expertise intersect. Human oversight combined with robust quantitative risk management can ensure that balanced exposure is maintained at the portfolio construction level. For example, a fund manager can limit exposure to any single industry or country to within 5% of the benchmark to ensure diversification and stability across the portfolio.

The future of AI in investment management

AI’s role in investment decision making will continue to grow driven by three key factors: the evolution of modeling techniques, the growth in computational power, and the explosion of available data.

However, careful management and expertise are required to ensure optimal results. While AI presents great possibilities, the key to success lies in the processes used to apply it. The industry has the opportunity to harness its power as it evolves, ensuring that both technology and human expertise continue to work hand in hand to deliver exceptional outcomes for investors.

*As co-managers of the M&G Global Equity Fund, Michael, Gautam and team leverage advances in AI, data science, and computer processes to provide stock-picking recommendations.