The evolution of financial markets is often shaped by regulation, and few examples illustrate this better than the development of South Africa’s Exchange-Traded Fund (ETF) market. While global ETF markets, such as those in the United States, have flourished over decades due to favourable tax and regulatory environments, South Africa’s ETF sector has grown more gradually. Exchange control policies historically influenced investor behaviour, asset allocation, and the growth trajectory of ETFs, creating a unique landscape in which regulatory decisions can significantly accelerate or hinder market development.

South Africa’s regulatory landscape for ETFs

Since 2005, ETFs in South Africa have benefited from a regulatory framework that differs from that of traditional Collective Investment Schemes (CIS). ETFs structured as CISs have been granted the ability to invest 100% of their assets offshore, while traditional CIS funds were historically capped at 45% of their retail assets for foreign investment. This distinction effectively gave ETFs a strategic advantage, allowing individual investors and family trusts to gain broader international exposure without the limitations faced by conventional mutual funds. The ETFs are still clarified as foreign investments for prudential regulation through.

The rationale for this preferential treatment was clear. National Treasury sought to expand market capitalisation, enhance liquidity on the Johannesburg Stock Exchange (JSE), and encourage foreign diversification via domestic investment channels. The South African Reserve Bank (SARB) supported these changes, recognising the benefits of daily reporting of ETF flows, which provides a more accurate picture of foreign investment activity than the quarterly reports required for traditional CIS funds.

Despite this structural advantage, ETF growth in South Africa was slower than expected. Several factors contributed: the dominance of active management in the local market, conservative adoption of index-tracking ETFs by asset managers and restrictive JSE listing rules that initially limited ETFs to passive strategies. As a result, the full potential of ETFs as a vehicle for investor diversification and market expansion remained untapped.

Breaking new ground with Actively Managed ETFs

A landmark change came at the end of 2022, when the JSE amended its listing rules to allow Actively Managed ETFs (AMETFs). For the first time, ETFs – whether actively managed or index-tracking – now operate on a level playing field. This shift opens the door for active fund managers to list portfolios that may include foreign assets, while still enjoying the favourable exchange control treatment historically reserved for ETFs.

This regulatory reform is significant for several reasons. First, it enhances investor choice, allowing retail and institutional investors access to a broader range of strategies that were previously unavailable. Second, it is expected to increase the number of ETF listings on the JSE, improving market liquidity and creating a more dynamic trading environment. Finally, it contributes to the financial ecosystem by generating onshore fee income from foreign investments, supporting local financial services while mitigating risks to South Africa’s Balance of Payments.

The Impact on investors and markets

The introduction of AMETFs marks a turning point for South Africa’s ETF market. Investors now have access to a wider variety of strategies, enabling better portfolio diversification and alignment with individual risk preferences. Retail investors, in particular, can participate in products that provide exposure to global markets without leaving the domestic financial system. For institutional investors, the availability of actively managed ETFs allows for greater flexibility in portfolio construction, risk management and performance optimisation.

From a market perspective, the expansion of ETFs supports increased capital inflows to the JSE, strengthens liquidity, and enhances the visibility of South Africa’s financial markets to international investors. By fostering competition between passive and active products, the reform encourages innovation, drives efficiency and enhances the sophistication of the overall market.

Alignment with national objectives

These developments align closely with the original goals set by the National Treasury when it introduced preferential exchange control treatment for ETFs. By expanding access to foreign diversification through local investment vehicles, the reforms encourage higher savings rates and the accumulation of wealth within the South African economy. Crucially, this is achieved without negatively impacting the Balance of Payments, as all investments are denominated in rand and ultimately remain within the domestic financial system.

Looking ahead

As the market adapts to these changes, we can expect several positive outcomes:

- Broader adoption of ETFs across retail and institutional segments.

Greater innovation in product offerings, with active strategies complementing existing index-tracking ETFs. - Increased market participation, liquidity, and transparency on the JSE.

- Strengthened financial infrastructure that supports local fee generation and sustainable growth.

The growth of South Africa’s ETF market demonstrates the power of well calibrated regulatory reforms to level the playing field, stimulate innovation, and create tangible benefits for investors. With exchange control barriers lifted and actively managed strategies now recognised alongside traditional index trackers, the market is poised to align more closely with global trends, offering investors new opportunities while reinforcing the strength and stability of South Africa’s financial ecosystem.

The introduction of AMETFs and their favourable regulatory treatment is not just a technical adjustment; it is a catalyst for transformation. By enhancing investor choice, enabling access to foreign markets, and driving deeper market engagement, these reforms are helping to realise the full potential of South Africa’s ETF market.

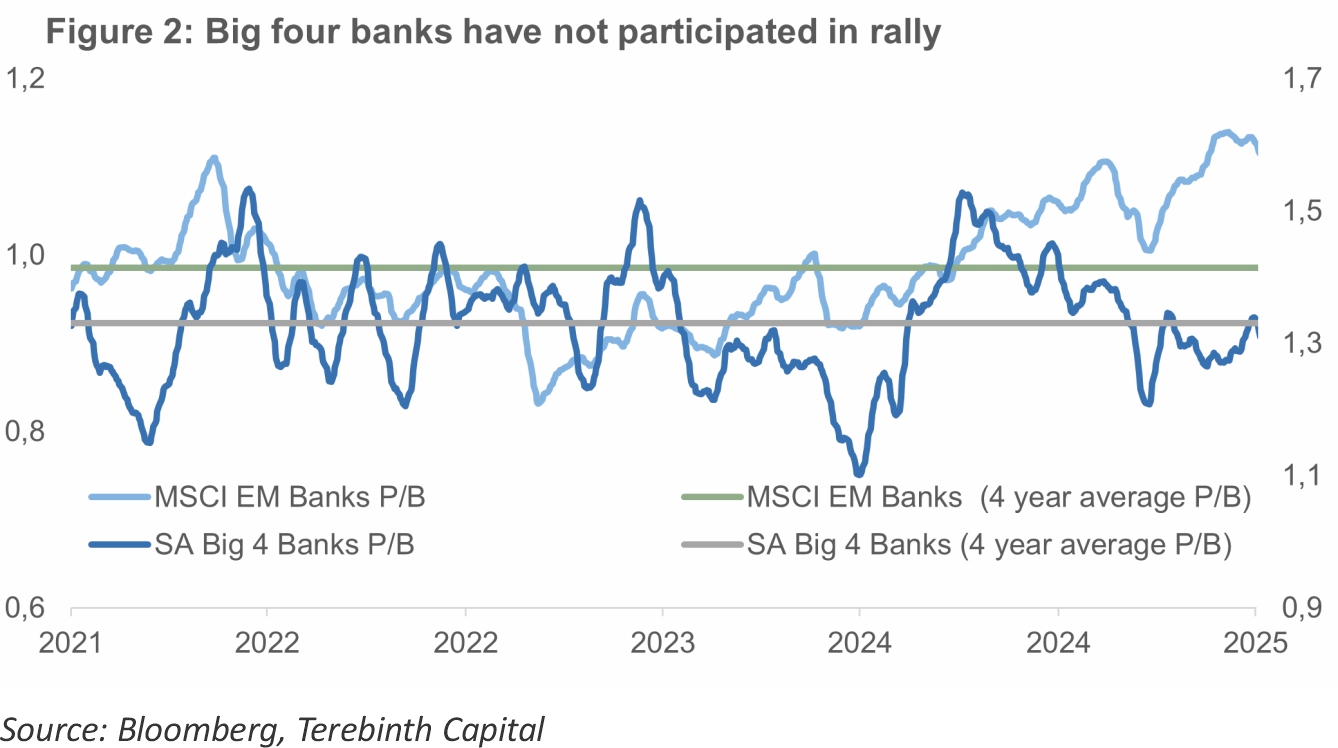

Banking on growth, but disappointing so far

This derating has occurred alongside significant downgrades to SA’s real GDP growth expectations (Figure 3). At the start of 2025, consensus expectations pointed to 1.7% growth, but this has since been revised downwards to only 1%. These downward revisions have amplified investor concerns about further downside risks to banks’ earnings expectations.

Despite a range of macroeconomic headwinds, including a stagnant job market, high credit costs, muted consumer sentiment and trade tariffs, the average earnings expectations for the Big Four banks have remained stable for 2025. Analysts continue to predict steady earnings per share (EPS) for the sector and have not lowered their expectations, although there may be some apprehension about potential upgrades due to previous disappointments in economic growth.

Encouragingly, insights from the recent reporting season point to a more positive bank earnings outlook. Management teams at the Big Four expect solid earnings growth for FY25, with average HEPS projected to increase by 8%. This points to stronger growth in the second half of FY25, underpinned by consumer resilience given monetary policy easing and limited loan defaults, reflecting a more favourable asset quality cycle. Another growth vector highlighted during the results season was revenue diversification across the rest of Africa, which contributed 34% and 41% to Absa’s and Standard Bank’s 1H25 earnings, respectively.

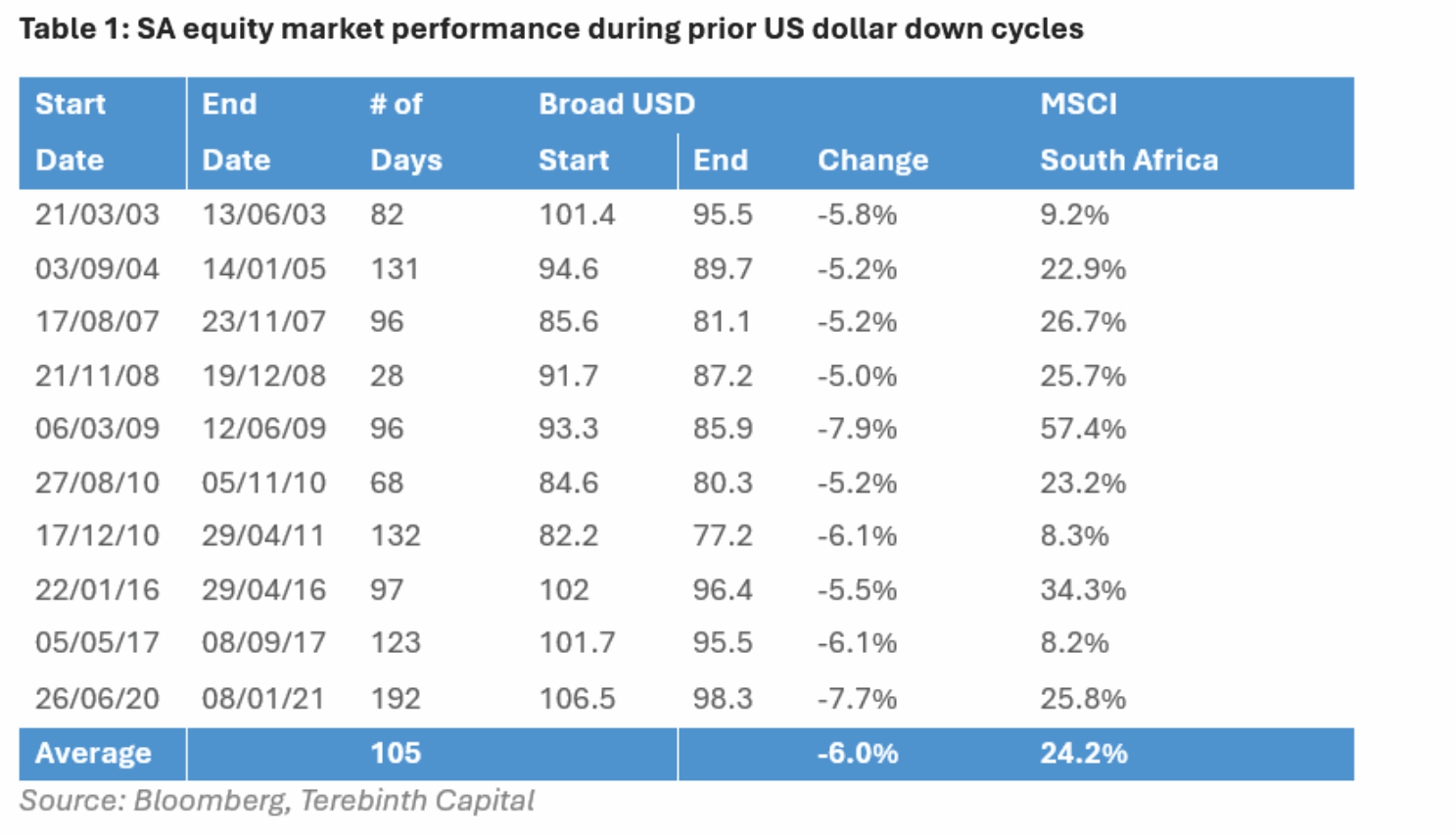

SA equities benefit from dollar unwind

Historically, a 5% decline in the US Dollar Index (DXY) has translated into a 20% boost in SA equity returns, on average, when measured dollars (Table 1), with all the major sectors (resources, financials, and industrials) benefiting. Given that the Big Four banks have significantly lagged the broader market, they could stand to gain more from the ongoing dollar unwind. From a positioning standpoint, many domestic asset allocators continue to prefer international assets, using their 45% offshore allowance[3]. A strengthening rand or a re-rating in local banks may force them to reconsider this strategy, which could further narrow the performance gap.

Balancing macro challenges with potential opportunity

It is fair to state that progress on domestic economic and policy reforms has not advanced as quickly as many had anticipated. However, there are some green shoots, particularly in the electricity and rail sectors, which are expected to deliver positive results in enhancing the overall economic environment. As these reforms advance, they may support the Big Four banks performance, potentially leading to a more favorable outlook for both investors and consumers alike.

Many investors remain cautious, preferring to wait for definitive evidence of a meaningful shift in growth, especially given numerous previous instances where such promises have failed to materialise. At the same time, several positive factors are at play including real wage growth, favorable terms of trade, and a weaker U.S. dollar. This adds to the optimism about an anticipated recovery. Given current valuations, the risk-reward balance appears attractive.

The evolving narrative around the Big Four banks highlights the delicate balance between macroeconomic challenges and emerging opportunities. This demonstrates the potential for growth if the right conditions are met and positions the banking sector as a focal point for investors watching the region.

[1] The Big Four banks in South Africa are Standard Bank, Absa, Nedbank, and FirstRand

[2] SBG Securities Unit Trust Review Q2 2025 [3] SBG Securities South Africa Strategy Update Fund Manager Moves Q2 2025