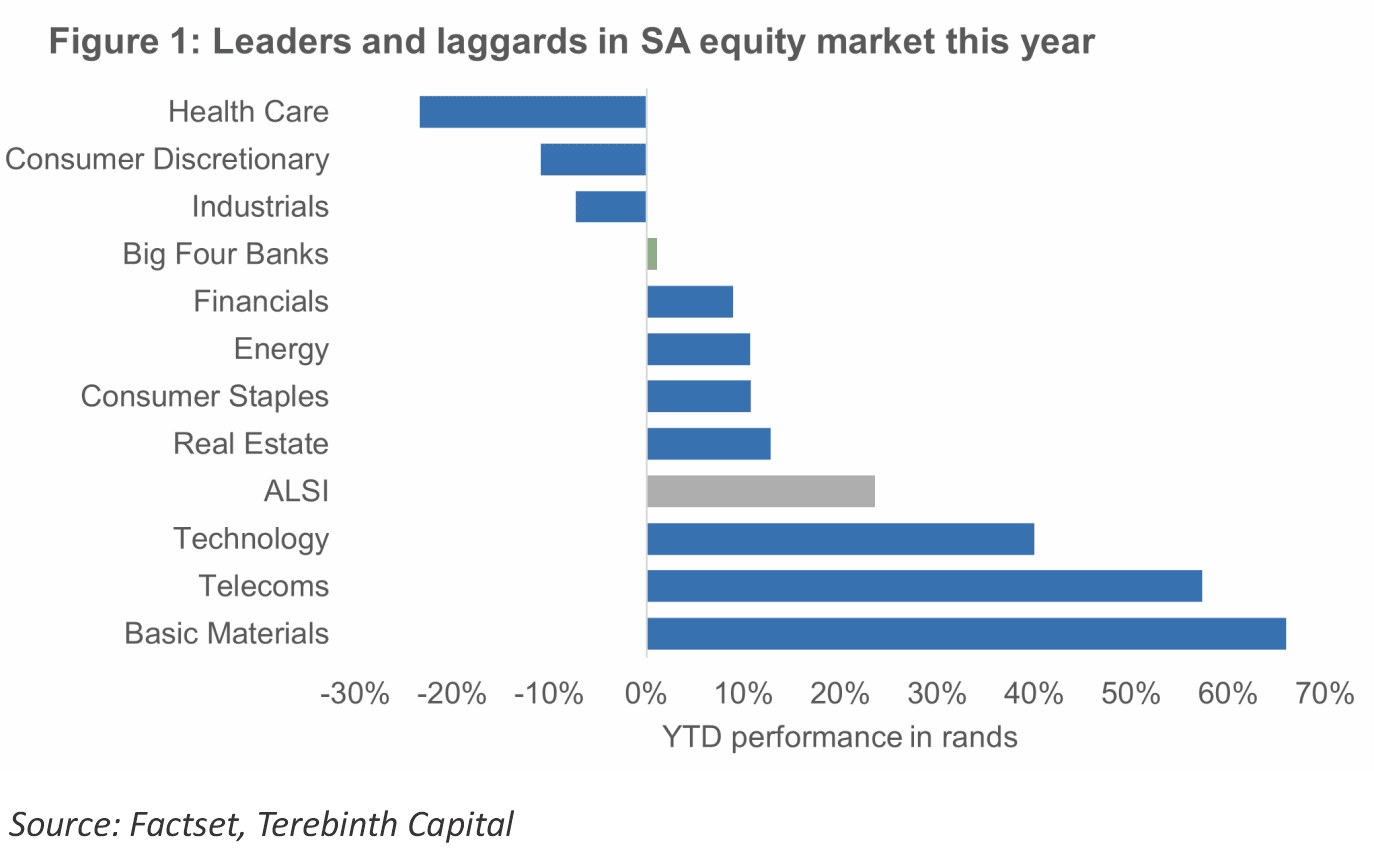

Emerging market (EM) portfolio inflows continue to recover, supported by a “Goldilocks” environment amid a shift in the Federal Reserve’s policy stance. South African equities have benefited from improving risk appetite, recording a 24% increase year-to-date to outperform both EM (12%) and global (7%) equities when measured in rands. However, these strong returns have mostly been driven by companies in the resources sector. In contrast, the major South African banks, specifically the Big Four[1], have not kept pace with the market (Figure 1). Investor caution is evident, as reflected in the underweight of banking stocks[2] within domestic portfolios.

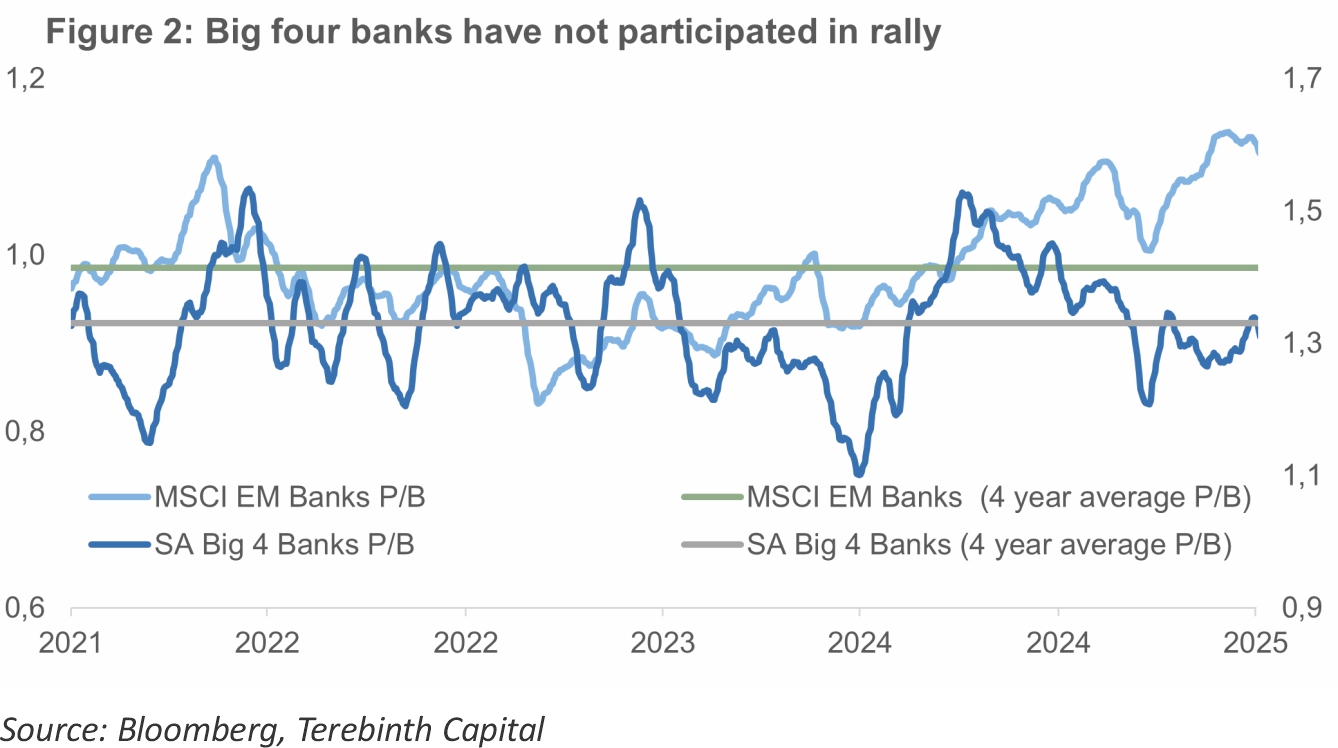

The Big Four banks have also lagged the rally in bonds, with a 6% decline in the average price to book (P/B) ratio despite the 60bp fall in the 10-year bond yield and unchanged earnings expectations. The current average P/B ratios are similar to levels seen during the height of loadshedding and real wage pressures in 2023 (Figure 2). Furthermore, the Big Four banks have underperformed EM banks, with their P/B ratios at four-year lows, while EM banks’ P/B ratios have risen by 7% this year. This divergence suggests that the Big Four banks are significantly undervalued.

Banking on growth, but disappointing so far

This derating has occurred alongside significant downgrades to SA’s real GDP growth expectations (Figure 3). At the start of 2025, consensus expectations pointed to 1.7% growth, but this has since been revised downwards to only 1%. These downward revisions have amplified investor concerns about further downside risks to banks’ earnings expectations.

Despite a range of macroeconomic headwinds, including a stagnant job market, high credit costs, muted consumer sentiment and trade tariffs, the average earnings expectations for the Big Four banks have remained stable for 2025. Analysts continue to predict steady earnings per share (EPS) for the sector and have not lowered their expectations, although there may be some apprehension about potential upgrades due to previous disappointments in economic growth.

Encouragingly, insights from the recent reporting season point to a more positive bank earnings outlook. Management teams at the Big Four expect solid earnings growth for FY25, with average HEPS projected to increase by 8%. This points to stronger growth in the second half of FY25, underpinned by consumer resilience given monetary policy easing and limited loan defaults, reflecting a more favourable asset quality cycle. Another growth vector highlighted during the results season was revenue diversification across the rest of Africa, which contributed 34% and 41% to Absa’s and Standard Bank’s 1H25 earnings, respectively.

SA equities benefit from dollar unwind

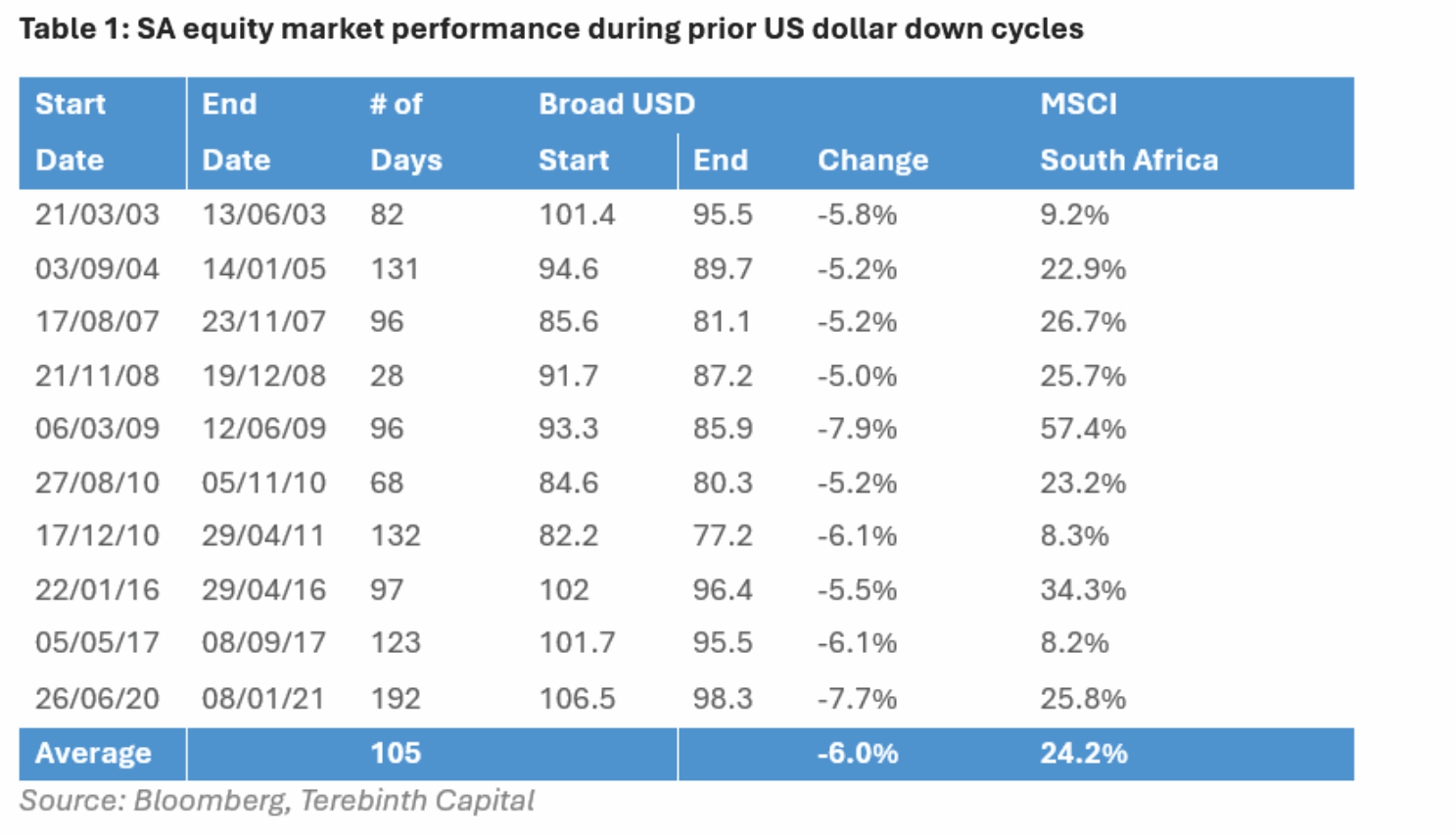

Historically, a 5% decline in the US Dollar Index (DXY) has translated into a 20% boost in SA equity returns, on average, when measured dollars (Table 1), with all the major sectors (resources, financials, and industrials) benefiting. Given that the Big Four banks have significantly lagged the broader market, they could stand to gain more from the ongoing dollar unwind. From a positioning standpoint, many domestic asset allocators continue to prefer international assets, using their 45% offshore allowance[3]. A strengthening rand or a re-rating in local banks may force them to reconsider this strategy, which could further narrow the performance gap.

Balancing macro challenges with potential opportunity

It is fair to state that progress on domestic economic and policy reforms has not advanced as quickly as many had anticipated. However, there are some green shoots, particularly in the electricity and rail sectors, which are expected to deliver positive results in enhancing the overall economic environment. As these reforms advance, they may support the Big Four banks performance, potentially leading to a more favorable outlook for both investors and consumers alike.

Many investors remain cautious, preferring to wait for definitive evidence of a meaningful shift in growth, especially given numerous previous instances where such promises have failed to materialise. At the same time, several positive factors are at play including real wage growth, favorable terms of trade, and a weaker U.S. dollar. This adds to the optimism about an anticipated recovery. Given current valuations, the risk-reward balance appears attractive.

The evolving narrative around the Big Four banks highlights the delicate balance between macroeconomic challenges and emerging opportunities. This demonstrates the potential for growth if the right conditions are met and positions the banking sector as a focal point for investors watching the region.

[1]The Big Four banks in South Africa are Standard Bank, Absa, Nedbank, and FirstRand

[2] SBG Securities Unit Trust Review Q2 2025 [3] SBG Securities South Africa Strategy Update Fund Manager Moves Q2 2025