In the world of institutional investing, few topics have stirred as much curiosity and controversy as crypto assets. Once considered a niche interest, digital assets such as bitcoin and ethereum have evolved into a significant topic of discussion among institutional investors, including retirement funds. We have seen an emergence of a new dimension to the global financial landscape, but should these assets be considered by retirement funds?

Let’s be clear: crypto assets are no longer fringe. They’ve gone from whitepapers to Wall Street, from Reddit threads to Reserve Banks. And yet, for South African retirement funds, the answer remains a firm “not yet”. While the crypto train is gaining speed globally, local regulatory frameworks are still evolving, and rightly so, given the need to balance innovation with fiduciary responsibility.

The allure of the digital gold rush

Despite initial scepticism, global interest in crypto assets among institutional investors has grown. Bitcoin’s meteoric rise, from a few cents to over USD100 000, has been nothing short of astonishing. Retirement funds in the United States, Japan and South Korea have begun exploring crypto exposure, primarily through regulated vehicles such as exchange-traded funds (ETFs). For instance, the Wisconsin Investment Board and the State of Michigan Retirement System have disclosed investments in bitcoin ETFs, signalling a shift in institutional sentiment.

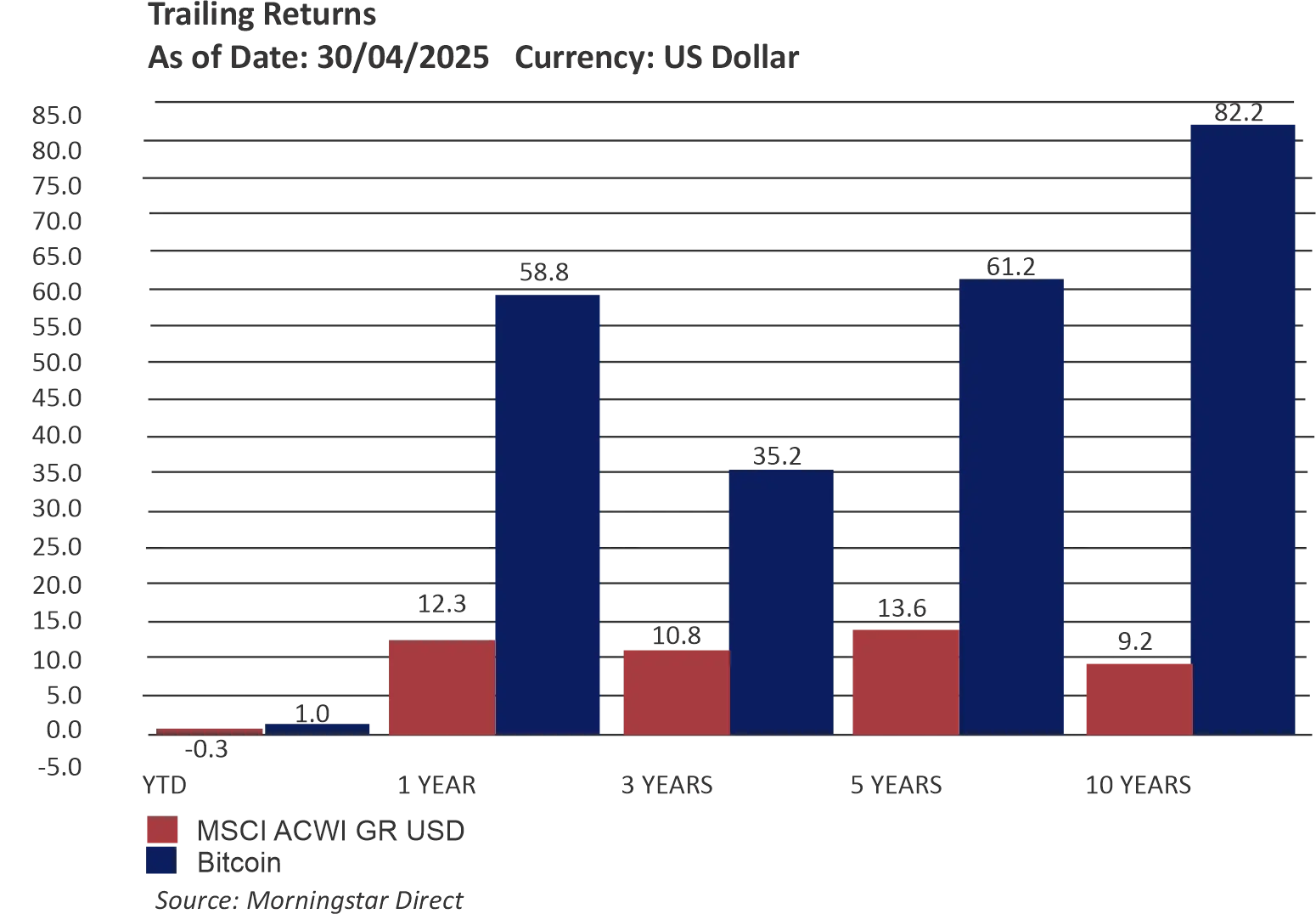

The appeal lies in the potential for high returns and diversification benefits. Bitcoin, for example, has significantly outperformed traditional equity indices over the past decade.

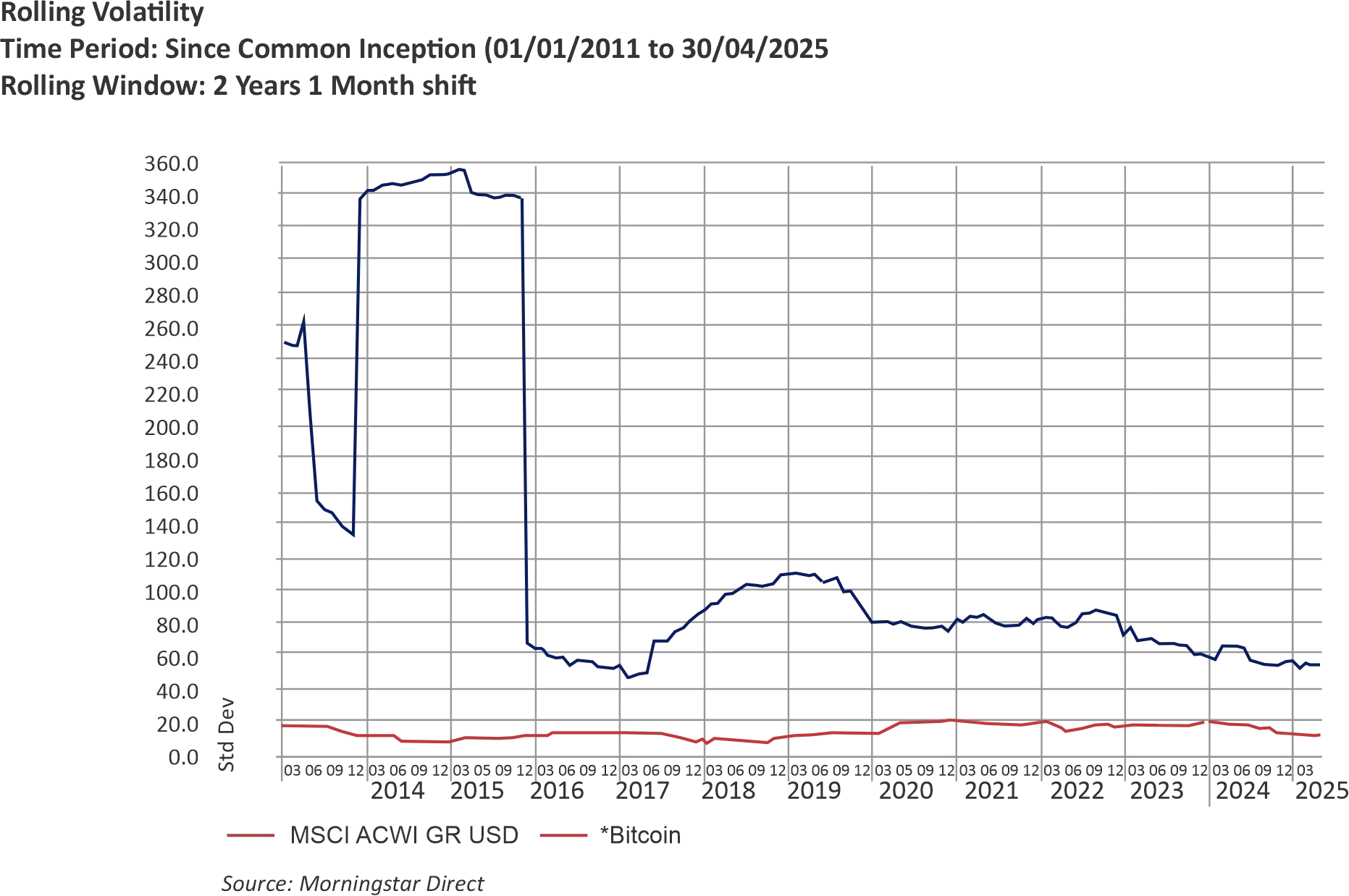

However, this performance has come with substantial volatility, even exceeding 100% over a two-year rolling period. While volatility has moderated, it remains a key concern for long term investors, such as retirement funds, where even a small allocation could introduce disproportionate risk. Fiduciaries must carefully assess whether such volatility aligns with the retirement fund’s investment objectives and the risk tolerance of its members.

Regulation: The gatekeeper of innovation

Globally, regulators are racing to catch up. The US has taken an increasingly assertive approach, with the SEC, CFTC, IRS and Federal Reserve all asserting oversight. The UK is positioning itself as a crypto hub, while Japan and Australia have embraced innovation with guardrails. China, on the other hand, has slammed the door shut.

South Africa? We’re cautiously optimistic. The Financial Sector Conduct Authority (FSCA) has declared crypto assets as financial products under the Financial Advisory and Intermediary Services Act. Crypto asset service providers (CASPs) must now register and comply with anti-money laundering and consumer protection rules. It’s a start, but it’s not yet a green light for retirement funds.

Regulation 28 of the Pension Funds Act is clear: retirement funds may not invest in crypto assets, neither directly nor indirectly. The “other” asset class bucket (capped at 2.5%) explicitly excludes crypto. The rationale? Protecting member savings from excessive risk and ensuring proper valuation, transparency and diversification.

The paradox of progress

Here’s the paradox: while South African retirement funds are barred from crypto, millions of South Africans aren’t. According to the FSCA, in its crypto assets market study, over 5.8 million people (nearly 10% of the population) own crypto assets. That number is expected to quadruple by 2030. Monthly trading volumes have exceeded R8 billion. The market is here, and it’s growing.

SARS has taken note, bringing crypto into the tax net. Gains and losses must be declared. The FSCA’s upcoming Conduct of Financial Institutions Bill may further integrate crypto into the financial services framework. The direction of travel is clear, even if the pace is measured.

What should retirement funds do now?

Stay informed. Stay engaged. And stay cautious.

Crypto assets are evolving rapidly, and so is the regulatory landscape. While direct investment is off the table for now, this could change. The development of stablecoins (digital currencies pegged to fiat) and the rise of regulated ETFs may offer safer, more palatable entry points for institutional investors.

In the meantime, retirement funds should monitor global trends, engage with their consultants, and educate trustees and members. The goal isn’t to chase hype – it’s to be ready should the rules change.

Looking ahead

The future of crypto assets in retirement fund portfolios depends on several factors: regulatory clarity, market maturity, risk management frameworks, and alignment with investment objectives. While current regulations prioritise caution, they do not preclude future inclusion under a more robust and tailored regulatory regime.

As the market evolves, opportunities may emerge for responsible and regulated investment in crypto assets. This could include limited allocations to stablecoins or ETFs, subject to appropriate governance and oversight. However, any such inclusion must be approached with care, recognising that even small allocations can introduce significant volatility.

Conclusion: Between risk and reward

Crypto assets are not a passing fad. They represent a new opportunity set, with all the associated complexity and controversy. It represents both a challenge and an opportunity for institutional investors. For South African retirement funds, the path forward requires a balanced approach – one that safeguards member interests while remaining open to innovation. The challenge to fiduciaries is to balance innovation with prudence, and opportunity with responsibility.

In the interim, retirement funds should remain vigilant, informed and compliant. The journey towards crypto integration is likely to be gradual, and any future inclusion must be earned through evidence, experience and sound governance. Even where global retirement funds have begun to invest in crypto, they remain early adopters, and their allocations are modest. Should South African regulations evolve, fiduciaries will need to assess whether crypto exposure, however small, aligns with the retirement fund’s investment objectives and risk tolerance. It is a journey worth watching, but one that must be approached with care.