The investment industry stands at an inflection point. As traditional sources of alpha become increasingly scarce, gender-aware alternative investment strategies offer a genuine competitive advantage. They mitigate long-term risks, provide diversification, and access growing markets that conventional approaches miss.

Pension fund trustees can exert a powerful influence by taking deliberate investment decisions that will have positive consequences for women, by allocating capital towards the infrastructure asset class with its inherent high positive impact.

The case for gender equality is not just a moral imperative – it is a strategic investment. Nowhere is this more evident than in the infrastructure sector: the roads we drive on, the power plants that light our homes, the fibre that connects us, and the ports that move our goods. Yet too often, the economic value of including women in the planning, execution and benefits of these projects is overlooked.

Gender equality: a multiplier for development

Traditional investment models systematically underestimate the risks associated with inequality such as reinforcing exclusion, creating long- term vulnerabilities that manifest as social instability, talent shortages, and market inefficiencies. The 2021 Global Gender Gap Report indicates it will take 135.6 years to close the gender gap worldwide at current rates. For investors, this represents a century of untapped market potential and accumulating systemic risk.

Investments into the infrastructure sector traditionally focus on economic metrics: GDP growth and job creation on a macro level; and financial returns through tools such as the internal rate of return and payback periods on an individual level for investors. However, the most transformative infrastructure projects are those that consider their differential impact on women and men.

In the infrastructure sector, gender inclusion is particularly powerful because these assets shape the backbone of our economies. When infrastructure is designed with women in mind – offering safe transport, access to energy, and digital connectivity – the ripple effects are far-reaching: girls stay in school longer, women are able to enter the workforce, and entire communities become more resilient.

Evidence on the ground

As someone who represents institutional investors on the boards of infrastructure project companies, I have had a front-row seat to the shifts taking place in our industry. Over the past decade, I have seen meaningful progress in women’s participation at board and senior management levels – particularly in the renewable energy sector.

The business case for gender diversity at this level is unambiguous. McKinsey & Company’s research demonstrates that organisations in the top quartile for gender diversity on executive teams are 25% more likely to achieve above-average profitability. More striking still, companies with the most ethnically diverse executive teams outperform their peers by 36% in profitability.

What is even more compelling is what I have witnessed on the ground. Many of the projects we invest in embrace community development obligations – such as support for schools, clinics, or training centres in neighbouring communities. When these initiatives actively involve women, the outcomes are notably stronger, from increased health indicators in the area to enabling hundreds of women to start micro-enterprises online.

Electricity access is a prime example to illustrate this. In rural sub-Saharan Africa, women and girls spend hours each day collecting firewood. Electrification reduces this burden, freeing up time for education or income-generating activities. When infrastructure projects actively include women in planning and employment, the multiplier effects are remarkable.

India’s rural roads programme shows that improved road construction lowers mobility restrictions for women and improves social norms, with positive impacts on education. Considering that 70% of Africa’s rural population lacks access to all-season roads, investments into an upgraded road network will not only ensure safety, but it will also unlock untapped demand.

The return on investment in girls’ education is extraordinary. According to the World Bank, at a macroeconomic level, countries lose $12-30 trillion in lifetime productivity and earnings when girls don’t complete their education. The UNESCO Institute for Statistics notes that in sub-Saharan Africa, where 23% of girls of primary school age remain out of school, targeted educational investments can unlock massive economic potential.

Conclusion: the power of infrastructural investment

By considering environmental, social, and governance factors in investment decisions, asset managers can create value while protecting capital and delivering risk-adjusted returns for clients. Investors who embrace this broader view are likely to see long-term gains. Projects that serve everyone, including women, tend to enjoy better community buy-in, lower operating risk, and improved development impact.

Infrastructure that empowers women does not just uplift individuals; it transforms economies. Investors who measure what truly matters, not just short-term returns but long-term, inclusive value, will lead the way in building resilient, high impact portfolios.

AI models in practice

Using historically representative data from the investment landscape, AI models can be trained to learn underlying patterns and provide a rich view of the market. They can not only help you to predict investment outcomes but also deepen your understanding of how market factors interact.

At M&G Investments, in our Global Equity Fund, we primarily use supervised machine learning, selecting data we believe is relevant for predicting share price movements. This is crucial in complex, noisy environments where it’s easy to capture spurious relationships in data that might not be relevant in the future. In a pre-filtering process, we identify data sources such as economic, fundamental, pricing and technical data. We also increasingly use natural language processing (NLP) techniques to extract sentiment data from sources such as company filings. The model learns how this data relates to future share price performance.

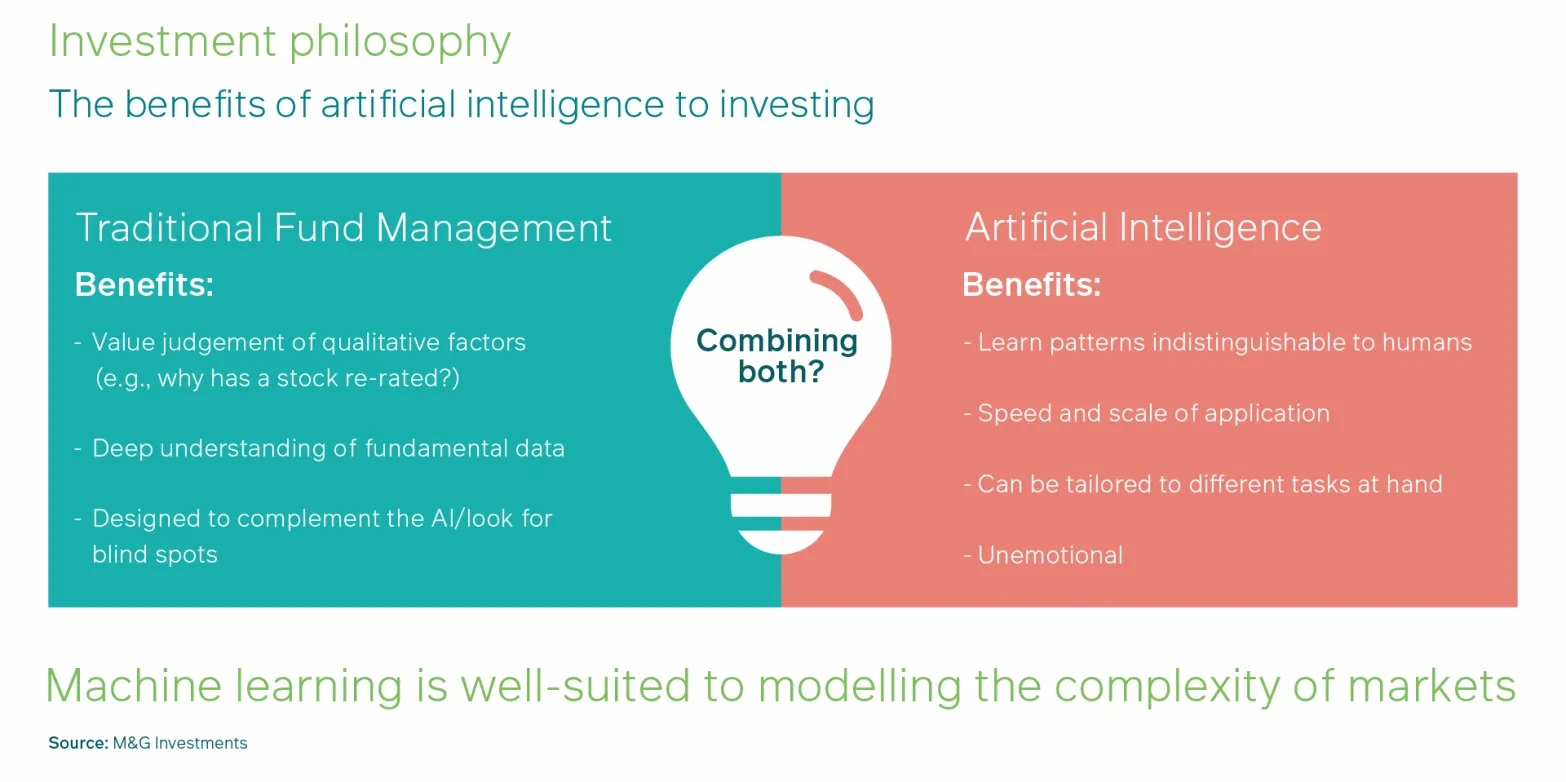

In our view, the real benefits of incorporating AI in the investment process come from blending the strengths of both humans and machines. This is the approach where we have seen real client benefit.

AI models can excel at identifying patterns and nuances in the data that are indistinguishable to human beings. They can also operate at a speed and scale that would be impossible for humans alone. AI models are also emotionless, which helps mitigate biases such as overconfidence or fear that can distort human decision making.

Yet AI isn’t infallible. Human judgment is crucial for addressing areas where AI models can’t always perform optimally. For example, humans can provide additional context to data, accounting for shifts in the market, and filling in the gaps where the AI might be blind to certain qualitative factors.

We believe that every stock selected should undergo a human check before being added. This to make sure that the things that have been accounted for are correct and consider any critical factors that may not be captured within the model. There are various techniques to manage large-scale data, to enable models to process nuances and outliers effectively. Not all outliers are errors, and models can be designed to distinguish between valid data and anomalies.

Risk management is another area where AI and human expertise intersect. Human oversight combined with robust quantitative risk management can ensure that balanced exposure is maintained at the portfolio construction level. For example, a fund manager can limit exposure to any single industry or country to within 5% of the benchmark to ensure diversification and stability across the portfolio.

The future of AI in investment management

AI’s role in investment decision making will continue to grow driven by three key factors: the evolution of modeling techniques, the growth in computational power, and the explosion of available data.

However, careful management and expertise are required to ensure optimal results. While AI presents great possibilities, the key to success lies in the processes used to apply it. The industry has the opportunity to harness its power as it evolves, ensuring that both technology and human expertise continue to work hand in hand to deliver exceptional outcomes for investors.

*As co-managers of the M&G Global Equity Fund, Michael, Gautam and team leverage advances in AI, data science, and computer processes to provide stock-picking recommendations.