Historically, during periods of high market volatility and uncertainty, investors have turned to gold. In their efforts to safeguard wealth, the precious metal has long served as a de facto safe haven, a role it continues to play to some extent today. Thanks to continuous innovation, investors now have a rich array of contemporary financial instruments at their disposal.

Since the global financial crisis, private debt, infrastructure investments, private equity and diversified credit have become important asset classes alongside traditional asset classes, forming what is now widely recognised as alternative investments. Today, these non-traditional alternative categories are regarded as an essential component of a robust and diversified investment approach.

There are several reasons for this. First, alternatives are increasingly attracting attention due to their superior returns and ability to provide stability in turbulent markets. Investors are recognising the value of diversifying their portfolios with these assets, which offer unique opportunities for growth and risk management.

Second, since alternatives have a low correlation to traditional investments, they also offer additional risk mitigation benefits at times when listed assets are experiencing turbulence.

Unlike alternatives, listed assets frequently experience significant price swings driven by market sentiment which can introduce unnecessary volatility and risk. In contrast, private market investments derive their performance primarily from the fundamental economic strength and operational success of the underlying assets. This focus on intrinsic value rather than short term sentiment significantly reduces their exposure to daily market fluctuations and the heightened volatility commonly associated with public markets.

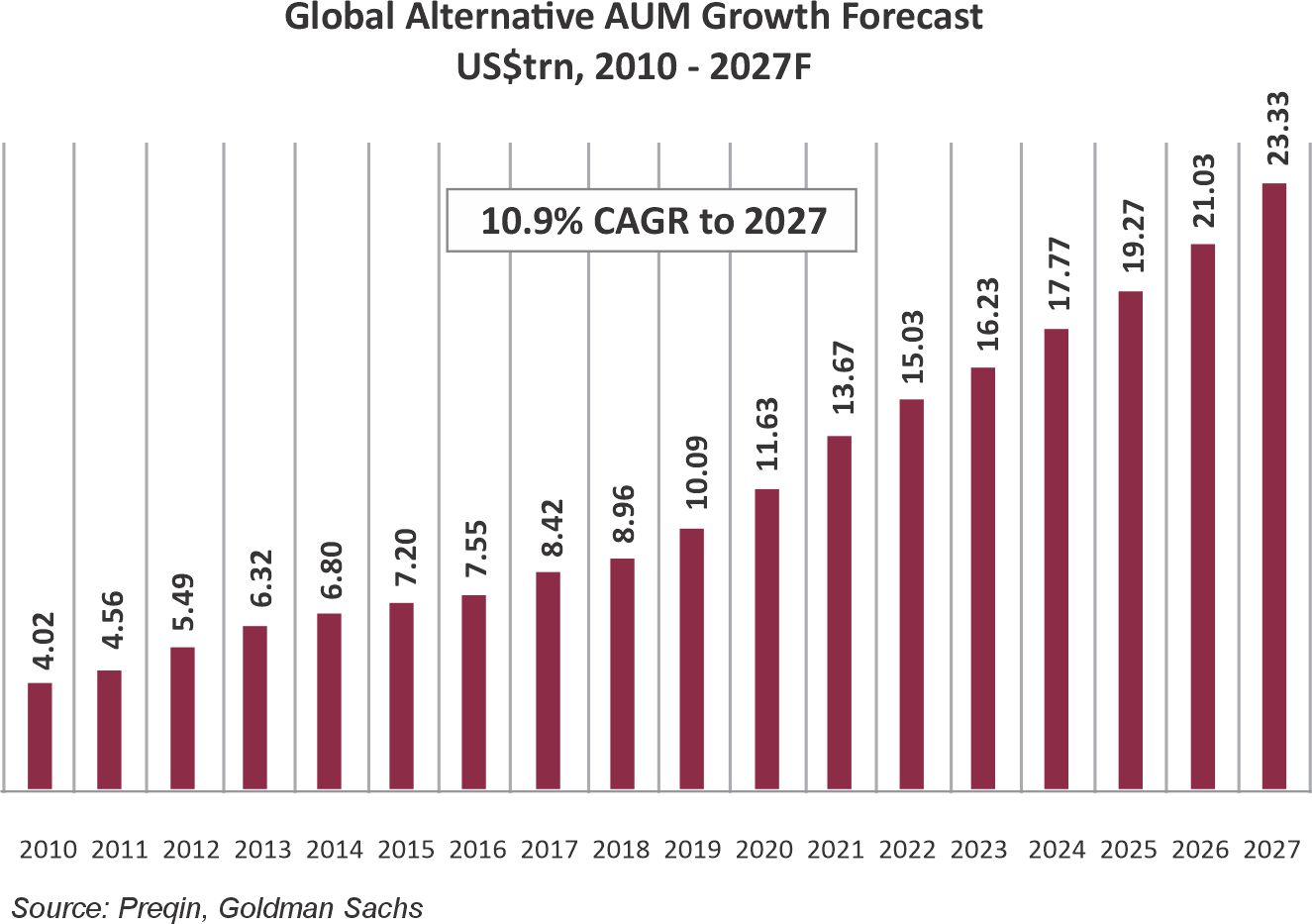

The numbers clearly support this view. From global assets under management (AUM) of US$4.02 trillion in 2010, alternatives are expected to surge into a US$23.33 trillion global industry by 2027.

What draws investors to alternatives? Part of the appeal of alternative investments is the significantly larger pool of companies available in the private market versus listed markets. With approximately 95 000 private companies around the world with revenues in excess of US$100 million, compared to about 10 000 listed companies with the same value, investors have access to more choice, across a wider range of sectors.

In South Africa, that gap is even wider with around 270 JSE-listed companies compared to almost 2 400 large private companies with 100 employees or more. Amongst these high quality privately held companies are some big names, like Consol, Tourvest, Imperial Logistics, Sorbet, 10X and Foodcorp.

The distinction between public and private exposure has grown even clearer in recent years, as companies globally are choosing to remain private for longer periods. Countries including South Africa, the United States, Europe, the United Kingdom and China are experiencing increased delistings, a trend driven largely by the availability of substantial private capital. Rather than a cause for concern, this shift reflects the attractiveness of private markets, offering businesses greater flexibility and stability away from public market volatility largely driven by investor sentiment.

These investors also value the more hands-on approach that comes with actively working with a company. This involvement could include bringing in new specialists to take the business to the next level, providing additional funding to spur on growth, or creating innovative product lines to unlock new markets. This active involvement enables alternative investment managers to deliberately add more value to already good, quality companies with strong cash-flows.

While alternative investment managers must dispose of the private assets within the life of their funds, which is typically 10 years, this impactful investing approach means that the businesses in question have already been elevated to a higher growth trajectory prior to exit, enabling the next investor to extract value over many years.

No asset class is completely bulletproof, but adding alternatives into a diversified portfolio undoubtedly boosts investment returns. In particular, private markets and real assets have historically delivered returns significantly above inflation, making them a highly effective hedge. This ability to preserve and potentially enhance real value becomes particularly significant during periods of market instability, offering a degree of resilience amidst broader economic uncertainties.

Since 2023, Regulation 28 of the Pension Funds Act has allowed South African retirement funds to invest 15% of capital allocation into private equity and a maximum of 10% into hedge funds. While pension fund allocations to alternative investments in South Africa is still relatively low at c. 4%, this is in line with where P7 pension fund allocations were almost twenty years ago (now at c. 25%), indicating that the direction of travel is in line with global trends.

South African investors are increasingly recognising that over and above delivering attractive risk-adjusted returns, alternative investments also provide a direct and more effective path to achieving positive impact outcomes making it a critical asset class that deserves more attention, specifically in the South African context.

Using the efficient frontier portfolio construction logic, typically one would buy portfolios that offer a combination of equities and bonds, which enables the investor to achieve an optimal blend of risk versus return. This is generally reached using a combination of stocks, bonds, listed property and cash. However, when adding private markets to the portfolio, you increase the expected return outcomes without adding more risk. Thus, allowing for a more efficient and resilient portfolio for today’s uncertain times.

This approach certainly does not position alternative investing as a replacement for listed equity and traditional asset classes but instead serves as an additional lever providing a unique set of characteristics that enhances both the risk and return features of any diversified portfolio.

When it comes to long term impact, private markets are unparalleled in their ability to effect tangible societal change, particularly in the realm of job creation. For a country like South Africa, investing in these markets represents a highly valuable commitment to the future.