The South African retirement fund industry is on the edge of a precipice. Crumbling under low savings rates, disengaged members, rising inequality and complex reforms like the two-pot system, the time for gradual change is over. The time for evolutionaries – bold, tech-enabled changemakers who challenge outdated models – is now.

In a world rapidly reshaped by technology, innovation and human-centric thinking, the traditional approach to asset investment and benefits is no longer fit for purpose. Evolutionaries, trustees, asset managers, administrators and employers are reimagining this ecosystem to prioritise outcomes over processes and people over policies.

This is a call to action: Adapt or become irrelevant.

Who are the evolutionaries?

The evolutionaries are those disrupting norms to build systems that work, for real people, in the real economy. These innovators:

- Digitise onboarding to reduce friction

- Embed AI in investment strategies

- Offer members real-time dashboards

- Prioritise digital governance and financial literacy

But being evolutionary isn’t about flashy tech. It’s about questioning assumptions and designing features that empower every South African to retire comfortable and with dignity.

Why evolution is urgent

South Africa’s retirement savings ecosystem faces deep-rooted challenges:

- 90% of members are likely to retire with inadequate savings.

- Financial literacy is patchy, especially among vulnerable populations.

- Retirement products are complex and often poorly understood.

- Engagement is weak and communication is generic.

- New two-pot system regulations add further layers of change, demanding smarter systems.

The old models won’t survive this pressure. We need adaptive technology, data-led insights and deep human empathy to rebuild trust and relevance.

Revolutionising the member journey

Evolutionaries are flipping the script. They’re not waiting for mandates, they’re redesigning benefit structures, investment defaults and engagement strategies.

Some of the most powerful shifts include:

AI-driven personalisation: Chatbots, robo-advisors and behavioural nudges provide custom investment choices and withdrawal planning.

Predictive analytics: Funds use salary, career stage and savings behaviour to guide members to better decisions.

Flexible product design: From drawdowns to annuities, members are offered options that reflect income volatility and changing life stages.

Mental wellness integration: Benefits now include financial counselling and mental health support, because holistic wellbeing matters.

These aren’t nice-to-haves. They are competitive necessities.

The stokvel lesson: Real behaviour, real innovation

South Africa’s informal saving structures, such as stokvels and burial societies, mobilise over R50 billion annually across 11 million members. That’s not a statistic; that’s a wake-up call. People are saving, but not always within formal channels. Why? Because traditional systems don’t reflect their reality.

Evolutionaries use AI to understand these patterns. They design for real life, not boardroom theory.

What needs to change, now

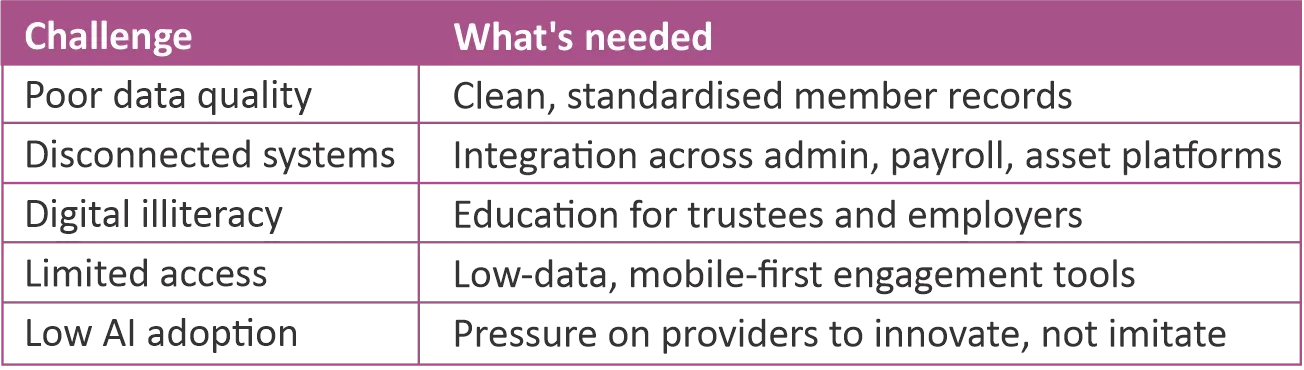

To operationalise this vision, five barriers must fall:

This is a leadership issue. Technology is ready, the question is: Are we?

Futureproofing with AI

Artificial intelligence is not a buzzword. It’s a toolkit, already transforming:

Fund administration – AI auto-validates contributions, flags data issues, speeds up claims.

Member communication – Personalised nudges warn of under-saving or simulate two-pot withdrawals.

Fraud detection – Algorithms detect irregularities and secure data using biometrics.

Smart investment – Machine learning optimises portfolios, evaluates risk and screens ESG compliance.

This is not about automating people out. It’s about freeing service providers to focus on what matters: the member.

If you’re not transforming, you’re failing

One leading umbrella fund reduced claim turnaround by 30% by partnering with a fintech to digitise the member journey; member satisfaction soared. Another saw higher preservation rates after launching personalised education on the two-pot system.

The return on innovation is real. So is the risk of doing nothing.

If funds and employers fail to evolve, they will lose trust, relevance and membership.

10 traits of a future-ready fund

1 Tech-enabled, self-service member tools

2 Flexible investments tailored to life stages

3 Real-time, data-driven decision-making

4 Personalised digital engagement

5 Embedded, proactive financial literacy

6 Responsive design aligned to regulatory change

7 Digital-first claims and administration processes

8 Integrated healthcare and insurance benefits

9 ESG-aligned investment frameworks

10 Governance built for innovation

This is the moment: Be the evolution

The retirement industry doesn’t need more strategies. It needs leadership that dares to evolve.

Trustees: Stop approving generic proposals and start demanding intelligent solutions.

Employers: Invest in member education the way you invest in marketing.

Service providers: Build platforms for people, not just for compliance.

The industry: Collaborate, experiment, iterate.

We are no longer in a time of slow reform – we are in a time of radical redefinition. Those who step forward now will shape not just products, but the futures of millions.

The choice is simple: Be the evolution or be left behind.