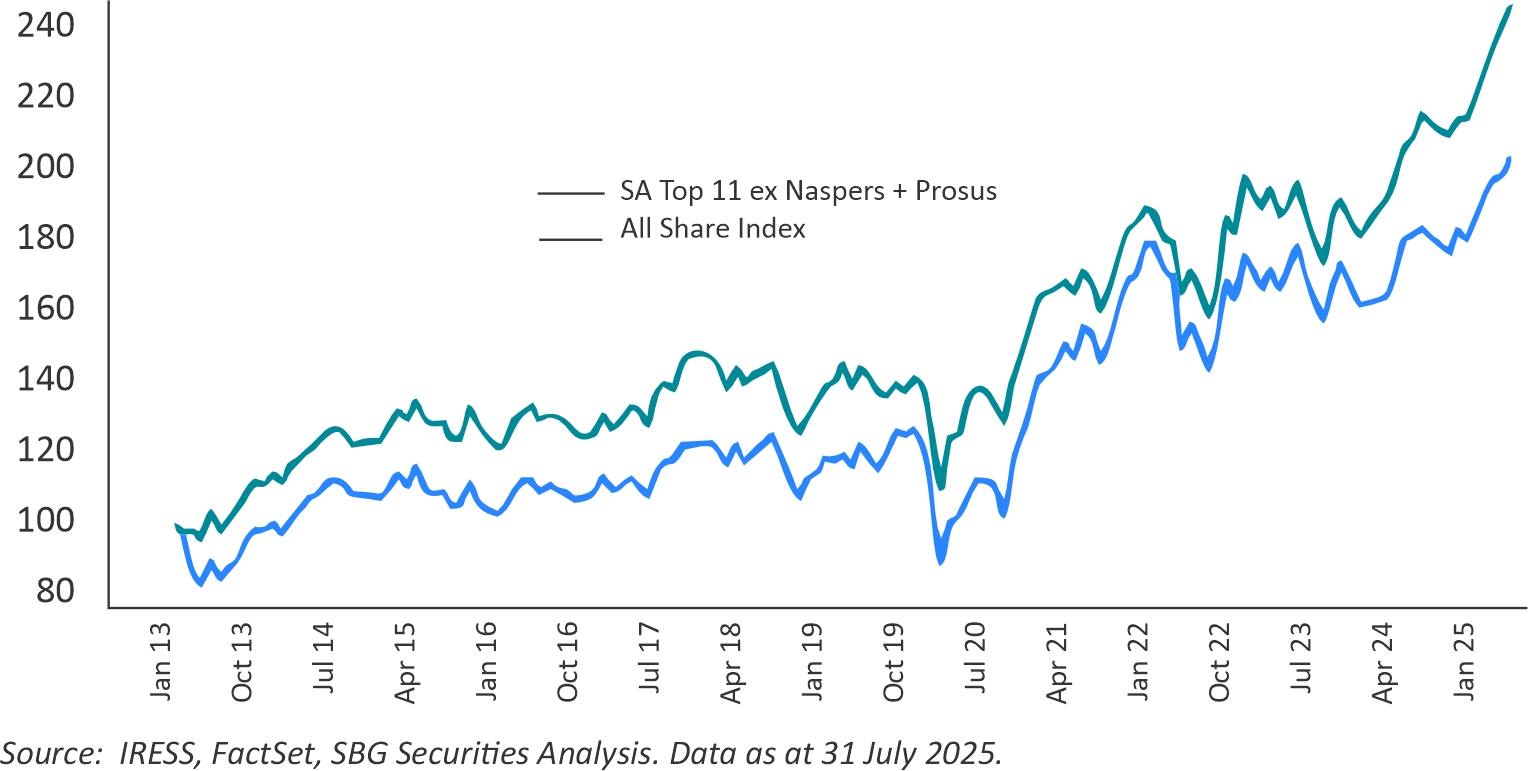

Over the past 12 years, Prosus has been a standout performer for South African investors. In fact, returns on the All-Share Index would be some 17% lower if Naspers and Prosus were excluded from the Index over this period. Despite its relatively complex corporate structure and limited local assets, Prosus has created immense value for South Africans by offering investors access to one of the most powerful technology ecosystems in the world: Tencent.

From Tencent-Minus to Tencent-Plus

Prosus owns 23% of Tencent; however, the company’s e-commerce portfolio – largely food delivery and classifieds – has been a drag on cash flows, relying on Tencent’s profits and dividends to support loss-making businesses. Recently, a renewed focus on profitability and cash generation has shifted the narrative. With these e-commerce operations now free cash flow positive, Tencent’s contribution is additive rather than subsidising, transforming Prosus from “Tencent-minus” to “Tencent-plus.”

Tencent: The core growth engine

Tencent accounts for roughly 80% of Prosus’ NAV. But, because Prosus trades at a 30% discount, investors can effectively access one of the world’s top 20 largest companies by market cap and its unparalleled super-app ecosystem at a significant discount.

Tencent’s reach is extraordinary. WeChat, developed by Tencent, is the world’s largest Super–App, with 1.3 billion active daily users. What started out as an instant messaging platform (China’s equivalent of WhatsApp) now underpins an ecosystem that spans messaging, social media, music, short-term video, payments, advertising, gaming, cloud and e-commerce. Given China’s regulatory environment, this closed ecosystem effectively replicates the global suite of social media platforms within a single network, creating a moat of scale and exclusivity. Think WhatsApp, Instagram, Facebook, YouTube, Spotify, PayPal and little mini-Amazons, in one closed-loop ecosystem.

Additionally, Tencent is the world’s leading games company in terms of revenue and the pioneer of mobile games. It owns many Blockbuster titles, either self-developed or through its global network of over 100 game studios. But the real reason for their gaming success is their enormous distribution platform in WeChat, where many of these mobile games are played.

Multiple levers of growth

Tencent’s underlying business streams hold various growth levers which have the potential to drive sustainable profitability over the medium term. These include:

Under-monetisation: Remarkably for its size, Tencent is under-monetised as it puts the user experience first. In gaming, its average revenue per paying user is 30% behind the industry level. In advertising, its ad loads on short-term video are one quarter of those of its Chinese competitors, whilst Moments (the Chinese equivalent of Instagram) has three adverts per day, as opposed to over 30 in the US!

The Chinese consumer: Whilst the gaming business is relatively defensive, Tencent is cautiously expanding into e-commerce via mini-shops and leveraging Tenpay, its vast payments network, to compete with Alipay. A cyclical recovery in China’s consumer sector could further accelerate this growth.

Artificial Intelligence: Rather than spending heavy capex on data centres, Tencent is deploying AI internally to optimise advertising, enhance gaming experiences, and sharpen consumer insights across its 1.3 billion-user base. With China Tech holding its own with the likes of DeepSeek and rapid advancements in AI chip production, the ecosystem is well-positioned to scale innovation without dependency on Western suppliers.

A compelling investment case

Tencent, via Prosus, remains a compelling investment case offering:

A strong competitive moat: 1.3 billion users within a closed ecosystem.

Earnings growth: Forecast growth of ~15% per annum.

Compelling valuation: Prosus trades at a 30% discount to NAV, and Tencent trades below many US tech valuations, with similar earnings growth.

Reduced risk: Regulatory pressures in China have eased, and while US–China relations remain a risk, China is no longer alone in having to negotiate a new trade order with the US.

Prosus remains a high-conviction stock for South African investors. By owning Prosus, investors currently gain exposure to Tencent’s vast, diversified ecosystem at a discount, underpinned by multiple under-monetised growth levers. From social media and gaming to payments and AI, Tencent’s reach ensures Prosus is positioned to continue delivering long-term value.