The need for infrastructure build and repair in South Africa is gaining momentum – none too soon. Large infrastructure spending plans have featured in recent National Budgets, but delivery has consistently fallen short. That’s why the announcement by the Minister of Finance in the 2025 Budget that infrastructure investment will receive an additional R46.7 billion in government funding, forming part of a total of R1.03 trillion planned over the next three years, is a welcome development. The aim: to accelerate economic growth, broaden financial inclusion, and strengthen national infrastructure.

The government is also implementing several initiatives, including:

- Operation Vulindlela, a joint initiative of the Presidency and National Treasury to fast track structural reforms and support economic recovery; and

- The Infrastructure Fund and Infrastructure South Africa, intended to improve the scale, speed, quality, and efficiency of growth-enabling infrastructure investment.

On the regulatory side, steps are being taken to attract greater private capital participation. A government review aimed at expediting project planning and financial structuring is well advanced. Notably, on 7 February, Treasury gazetted amendments to the regulations governing public-private partnerships. From June 2025, projects valued below R2 billion will no longer be subject to the same onerous approval processes intended for large-scale developments – thereby removing a long standing bottleneck.

What role can retirement funds play?

Retirement funds have a crucial role to play in South Africa’s infrastructure development story. Regulation 28 of the Pension Funds Act has been amended to allow pension funds to allocate up to 45% to infrastructure investments. Despite this, actual allocations remain well below this limit. Based on Mergence analysis, only around 2% of the investable pension fund universe is currently allocated to infrastructure.

Trustees frequently cite several concerns, including:

- A perception that infrastructure is too risky

- Opaque or complex fund structures

- Limited availability of investable infrastructure assets

- Liquidity constraints, given the long term nature of these investments

- A lack of performance track record by managers

These are real issues, but they should not be insurmountable.

Why consider infrastructure?

Infrastructure investments can offer the kind of returns pension funds need to meet long-term liabilities. Some of the key benefits include:

- Portfolio diversification

- A hedge against long term liabilities and inflation

- Reduced volatility

- Capital preservation

- Sound, risk adjusted returns across economic cycles

- Enhanced yield underpinned by stable cash flows

- Returns uncorrelated with traditional asset classes

- Measurable impact, uplifting communities and boosting economic growth

How can funds access infrastructure?

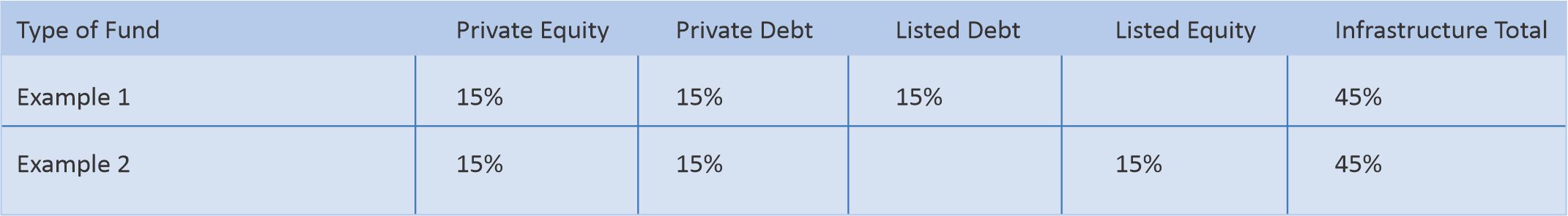

The revised Regulation 28 limit of 45% includes exposure across various instruments:

- 15% in unlisted infrastructure equity, such as through private equity funds;

- 15% in unlisted infrastructure debt, either through direct exposure or via infrastructure debt funds; and

- 15% in listed infrastructure assets.

The table below illustrates the regulatory limits across these categories:

Investments are typically aligned with long term themes or the United Nations Sustainable Development Goals. The specific sectors available depend on the manager’s focus, ranging from energy, water and sanitation and transport to digital infrastructure and affordable housing.

Instruments and vehicles available

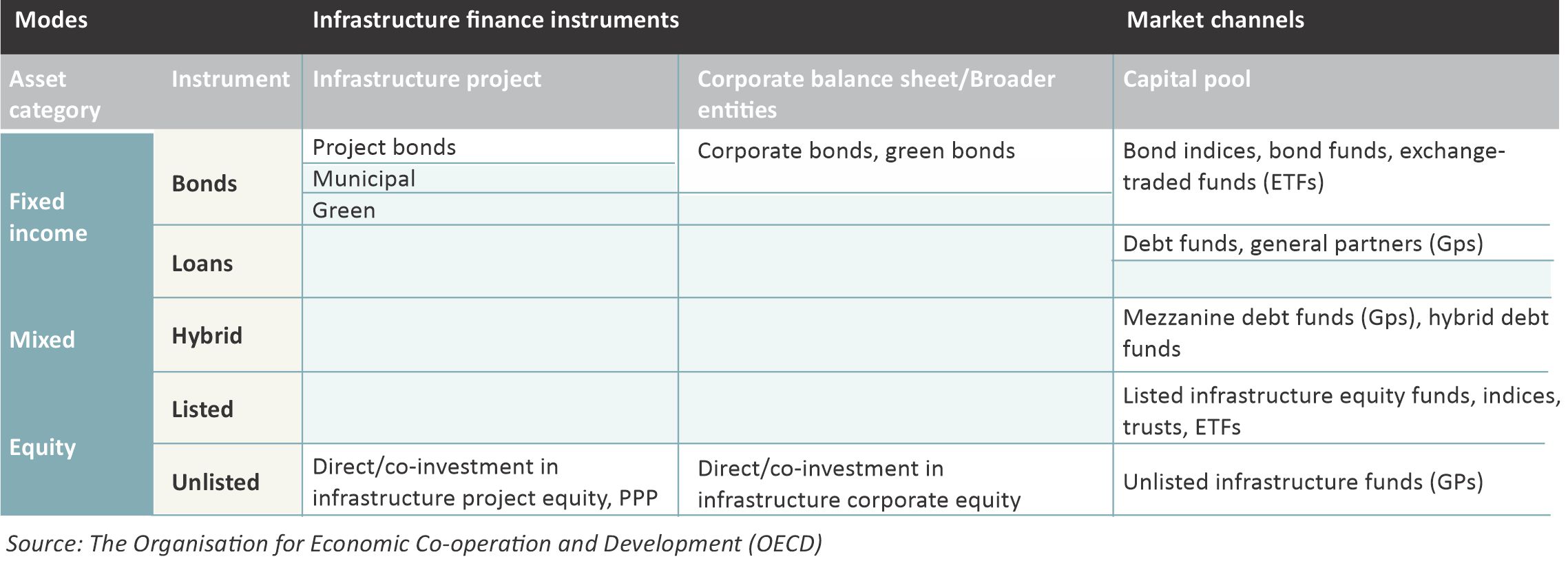

Globally, investors can access infrastructure through a wide range of instruments and vehicles. In South Africa, however, the market is still developing. As shown in the image below, the current local landscape includes only a handful of pure infrastructure plays listed on the JSE, with green bonds and project linked bonds representing a growing but still relatively niche segment.

Infrastructure assets | SA investment instruments & vehicles (current)

Given these limitations, the most direct and effective way for pension funds to gain meaningful infrastructure exposure is through private markets. This includes unlisted equity and debt investments, accessed via specialised infrastructure funds managed by experienced asset managers.

When evaluating potential managers, trustees should conduct a thorough due diligence, paying close attention to the manager’s track record, governance structures, transparency and reporting quality. An independently verified impact report can also provide insight into both financial returns and social or environmental outcomes.

What sort of returns can investors expect?

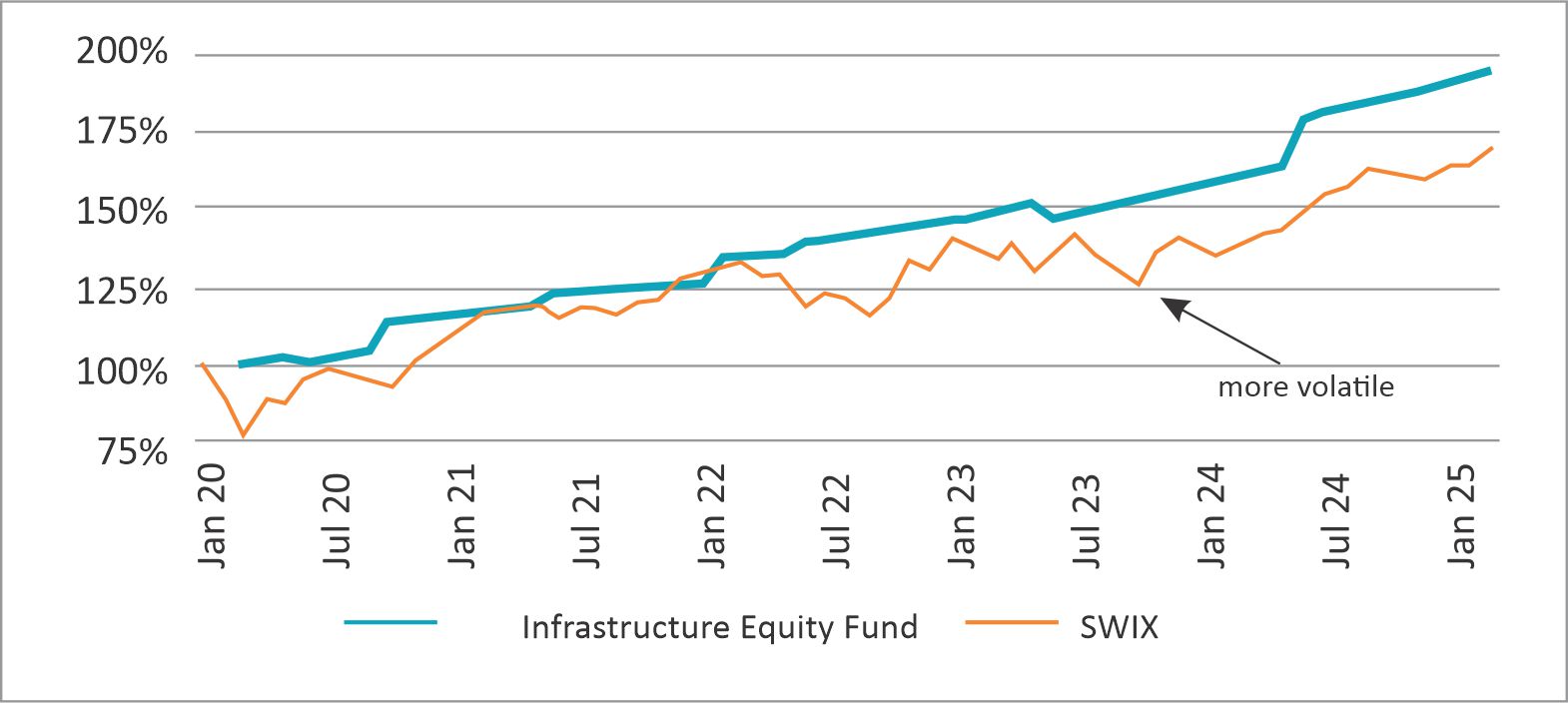

Returns vary depending on the sector, strategy and asset manager. However, unlisted infrastructure assets typically provide long term, stable income streams that are less correlated with listed markets. The graph alongside illustrates the historical performance of a representative unlisted infrastructure equity fund compared to the SWIX index, highlighting the potential for more stable and resilient returns across economic cycles.

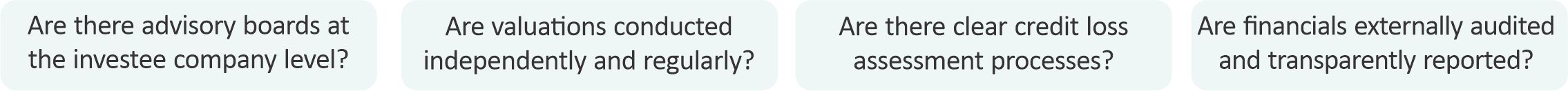

Addressing opacity in fund structures

One of the most frequently cited challenges is the perceived opacity of fund structures. Trustees are right to be cautious and are encouraged to interrogate the following:

Asking these questions helps ensure that governance is in place to manage risks and align investment structures with fund mandates.

A growing opportunity not to be missed

There is a compelling opportunity for retirement funds to help meet South Africa’s infrastructure development needs while also achieving long term, inflation hedged returns. With reforms under way, and with Regulation 28 paving the way for greater participation, trustees would do well to examine this asset class more closely.