Whether you are a Baby Boomer, belong to Generation Z, or are any age in between, you have become used to the convenience and immediacy that the internet has brought to our lives. From banking apps, to online shopping, to fast food deliveries, we have come to expect instant fulfilment from our service providers. Shoprite Checkers has taken that to the next level, delivering physical items to your doorstep within 60 minutes.

Yet, pension fund members – people with lifelong investments – often wait 24 hours or more just to get basic information about their retirement savings. In a world obsessed with immediate gratification, members are asking why it takes longer to get an answer about their life savings than it does to get a pizza!

To thrive, schemes must communicate like modern brands. That means they have to be personal, relevant, and instant. They must start talking to customers or members in ways that make sense to them, via platforms that they use. They should therefore start communicating using plain language rather than legalese, and they should provide real-time access to information, not monthly reports buried in emails and irrelevant data.

Fast, intuitive service communicates more than efficiency. It tells members they matter. It shows that their time is respected, their needs are a priority, and that their fund is reliable and modern. This isn’t about gimmicks. It’s about demonstrating that pension funds are as committed to their members today as they are to their futures. In an industry dealing with long term investments and deferred gratification, immediacy helps members feel in control of their future, reduces anxiety and uncertainty, and increases overall customer satisfaction.

Tools at your fingertips

Personalised and interactive apps are everywhere. Spotify suggests music you might like based on your playlists. Uber offers personalised ride options and recommendations based on your location and travel history. Why aren’t pension funds using the same technology?

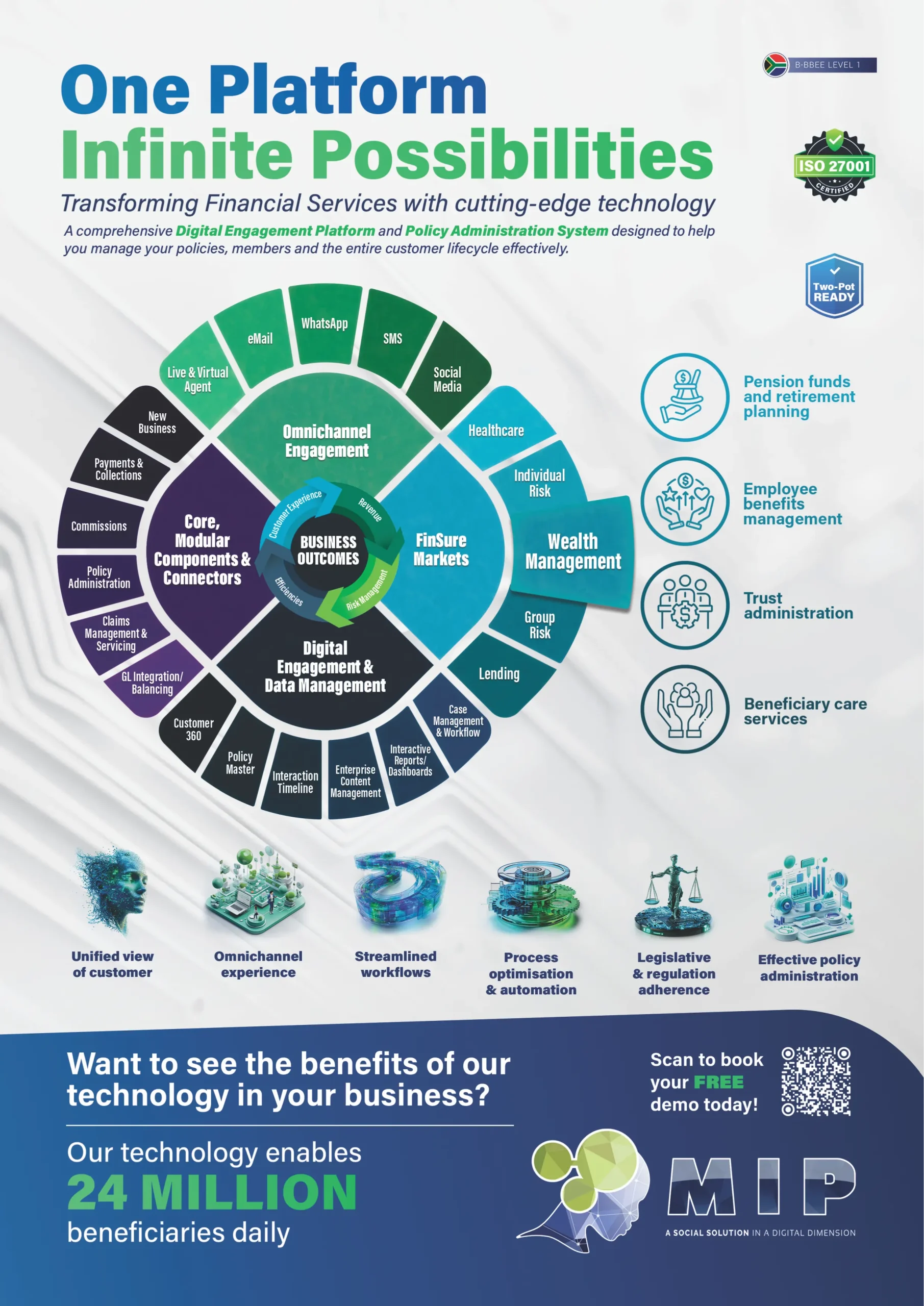

The tools exist. The data exists. What’s missing is the strategic shift toward user-first design and real-time engagement.

In Denmark, scenario modelling allows users to see how changing their retirement age affects their income. This, together with the fact the dashboard works alongside digital banking advisory tools, gives people convenient access to information and the opportunity to scenario-plan their retirement. The key here is that it is integrated into all your financial verticals, investments, banking, lending and insurance. It is the integration of services that is the new go-to strategy.

These aren’t futuristic ideas. They’re live, proven solutions that South African funds can adapt today.

Building confidence

Modernising pension engagement isn’t just good for members, it’s a strategic win for administrators and trustees too. Over and above building brand trust in a sensitive, long term industry, providing immediate, personalised interactions improves efficiency in the long term. Using technology in this way will reduce repeat queries and complaints, freeing up service teams to focus on value-adding tasks. It also helps improve disclosure and benefit timelines and reduces the chance of ombudsman cases or regulatory penalties.

The industry has reached a tipping point. Either it continues to treat members like passive investors waiting 40 years for a payoff, or it embraces technology and psychology to create engaging, real-time financial journeys. If members can track a delivery on their phones, they should be able to track their retirement in real time. The future of pensions isn’t just about income after 65. It’s about engagement now, and funds that get this right will lead a new era of financial empowerment.